Summary

- Abacus Life Settlements has emerged as a profitable opportunity in the SPAC wreckage, trading down about 35% since its merger.

- Abacus operates differently from its predecessor, Emergent Capital, by originating policies and selling them to investors or its subsidiary.

- Abacus has a proven track record of generating significant returns on investment and has attracted capital from major firms like KKR and Apollo.

Among the wreckage of 2021-era SPACs, an interesting, profitable opportunity has emerged. Abacus Life (NASDAQ:ABL) (NASDAQ:ABLLW) deSPAC’d this summer as a three-way merger between Abacus Settlements, Longevity Market Assets, and East Resources Acquisition Company, trading down about 35% since the merger. For the uninitiated, the life settlements business has not fared well in the public markets, and the recent flop Emergent Capital (OTCPK:EMGCQ), the artist formerly known as Imperial Holdings, left many with a bad taste in their mouth. I think Abacus may have cracked the code on this business and I wish to share some of the key differences in their business model.

Legacy Businesses

For more color on Emergent Capital, check out the old pitches on Seeking Alpha and Value Investors Club. The “business” was essentially a pile of ~600 life insurance policies with an average maturity value of around $5m. The investment was predicated on enough policies maturing in the early years to cover the premium payments for the entire portfolio until maturities picked up speed and provided an investment return. This never happened and the equity got wiped out. What went wrong?

- Maturities didn’t keep pace with the Emergent cost structure, and successive financing deals were completed on unattractive terms. This basket of static policies didn’t make much sense as a public company, given the uncertain timing of cash flow.

- Emergent primarily owned Universal Life policies. This further complicated the story as premiums increased with time, exacerbating cash burn beyond initial estimates.

- Skeptics rightly questioned Emergent’s ability to acquire a portfolio of policies with such high expected rates of return. Investors in this space need to understand the value added by a life settlement company or risk being the sucker at the table.

Abacus Model

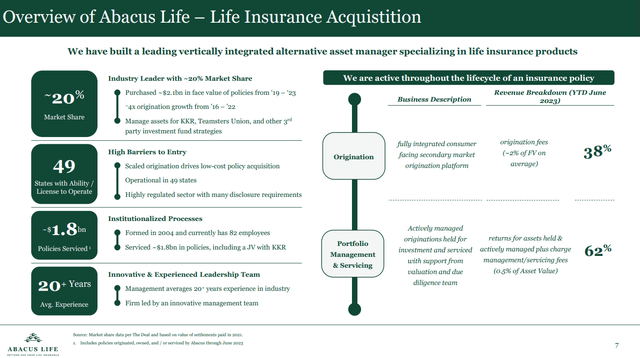

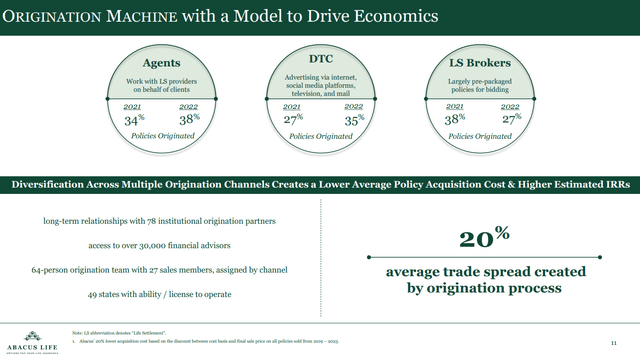

Abacus Business Model (Abacus Investor Deck)

Abacus buys AND sells policies and is not a static portfolio of held-to-maturity investments. Abacus originates a policy from a consumer, and then either sells the policy to a third-party investor or to their Longevity Market Assets subsidiary. They have scaled this business to be licensed in 49/50 states, successfully attracted capital from the likes of KKR (KKR) and Apollo Global (APO) in a separate JV (“Nova”), and have a proven track record of generating significant returns on investment.

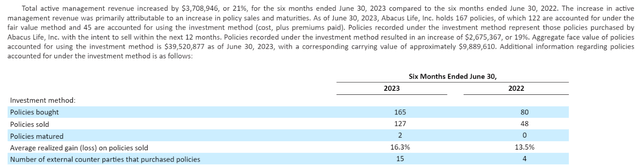

In terms of Abacus’s financial statements, revenue historically comes from two buckets of policies. Their trading basket, “Investment Method” policies that are intended to be re-sold within 12 months (think Available-for-Sale), and “Fair Value” policies that primarily remain on their books (think Held-to-Maturity). Revenues for the traded policies were recorded as the difference between purchased value and sale value. Revenues for the held-to-maturity policies are recorded as the change in fair value. For the first six months of 2023, they recorded $16.7m revenue from the traded (Investment Method) policies and $4.3m from the held (Fair Value) policies as follows:

Abacus Investment Method Policies (Abacus 10-Q)

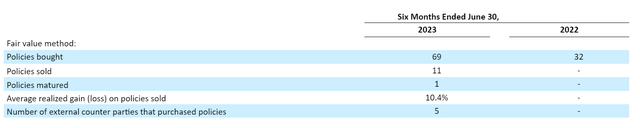

For the Fair Value policies, there was much less turnover, and policies are predominantly marked to the market to reflect changes in assumptions and experience.

Abacus Fair Value Policies (Abacus 10-Q)

For the first six months of 2023, Abacus reported $21.6m of revenue, of which $21.0m was from these two segments, and $0.6m was from their small portfolio servicing segment, which manages policies for outside investors. This translated to $20.1m of gross profit and $14.8m of net income after corporate expenses.

I want to take a minute to again highlight the differences from the Emergent Capital model. At first glance, you will see that Abacus had $38.4m of net cash used in operations for the first six months of 2023, suggesting they have the same cash flow issue as their ill-fated predecessor. However, Abacus invests as part of operating activities and was deploying cash during the first six months of the year. Net capital deployed was $50.9m, suggesting net income is a decent proxy for operating cash flow, ex movements in capital deployed. So, earnings should continue funding ongoing operations, and incremental capital should help accelerate earnings growth.

Note – starting in Q3, Abacus has elected to standardize their reporting and only report policies using the Fair Value method. This will result in policies being marked to market every quarter and should result in fewer earnings surprises.

Why Do They Exist?

Now let us discuss their “edge”, starting with an interview CEO Jay Jackson did this summer:

Jay. So I want to segue into your business model by pointing out that, in fact, if you buy a full life policy, the insurance company will say, “You know, you can come back and actually cash this in”. But I think what you told me yesterday is that you might be able to do even better than that. So maybe that’s a good segue into how Abacus works.

Jay Jackson: Right. So what we do is we actually re-underwrite that case, and what we do is provide an actual market value. So what the life insurance company is providing you is effectively your cash back. Imagine if you went to sell your home and the only option of the person you could sell it to was the person you originally bought it from. What kind of offer would you get for that or valuation would you expect to receive?

What we do is we re-underwrite that person, we get updated medical files, update their lifespan. We provide that lifespan data, which is incredibly valuable for people who are looking at other areas in their financial portfolio, how they could apply that, and then we say, “Okay, here’s your future premium cost over that time, here’s what an expected rate of return might be for that contract. Mr. or Mrs. Jones, that policy is worth significantly more. It could be worth significantly more than what the cash value is.” And that market value, on average, last year, Abacus paid out over eight times on average over their cash value. It’s an 8x, so it’s a significant rate of return, and that’s what makes it such a mutually beneficial transaction.

A natural follow-up is, why don’t the life insurance companies cut out Abacus and do this themselves, which was also addressed in the interview:

Jay Jackson: We are actually licensed in every individual state to go and re-underwrite that person, understand what the fair market value is. And some of our largest investors now that want to repurchase these policies are in fact life insurance companies. Where they might want to optimize that book of business in a more thoughtful and intelligent way. So whether it’s life insurance companies, reinsurers, I think the next phase in expansion in what we do, and they can’t come in and adverse select their own book of business. They’re not licensed to do so, but we can. And the most important piece here is we’re still providing the fair market value to that policy holder. That policy holder has a decision. We tell them most of the time, almost every time, that, “Hey, your best decision here is to keep the policy. However, if your needs have truly changed, if this makes financial sense for you and this is suitable, then this is the right decision for you and your family. Here’s what today’s value is. Look, in 10 years, this might be worth the million dollars that you originally took it out for, but today it’s worth $300,000.” And from a life insurance company’s point of view, they’re willing to purchase that risk back at the current net present value, let’s say at $300, release their cash reserves, and this makes a very smart economic decision for their own balance sheet.

In summary – Abacus is bridging the gap between the consumer and the insurance company, where insurance companies can’t go bid above market value to policyholders, but Abacus can. By working with Abacus, they can selectively reduce exposure to policies that have moved against them over time, and Abacus can earn a nice return working as a middleman:

Abacus Originations (Abacus Investor Deck)

So What?

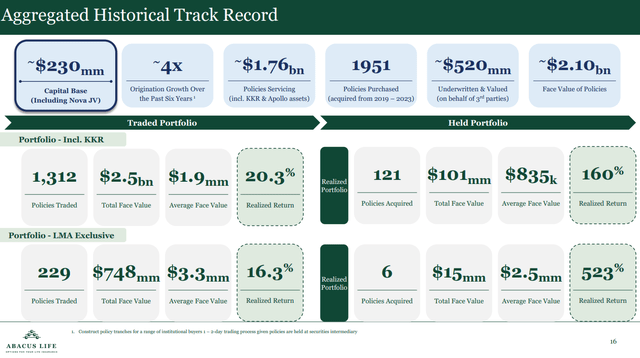

Using the above model, Abacus has generated an impressive set of returns over the past several years:

Abacus Track Record (Abacus Investor Deck)

Abacus seems to be demonstrating they can churn through traded policies at attractive return levels while holding onto policies where returns are most favorable. That said, there is an additional angle that makes the story even more interesting.

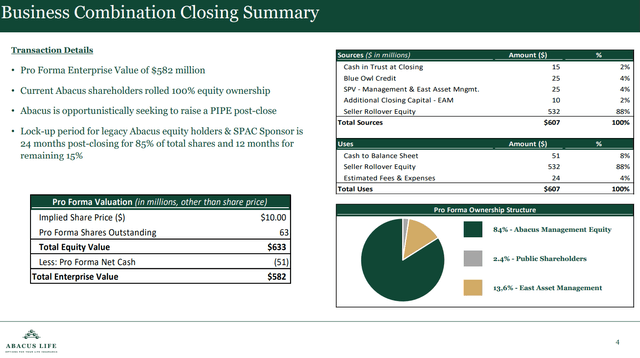

Abacus came public via the East Resources Acquisition Company SPAC, spearheaded by Terry Pegula and initially destined to acquire an oil & gas business. The industry pivot resulted in most shares being redeemed before deSPAC:

Abacus Merger (Abacus Investor Deck)

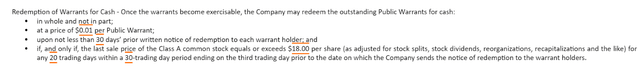

This somewhat hamstrung the business, as most of the cash was redeemed instead of remaining inside the business for deployment. It also resulted in a tiny outstanding float, with the vast majority of shares locked up for 12-24 months. There are also over 17m vestigial public warrants remaining from the redeemed shares and 8.9m private placement warrants, exercisable at $11.50/share.

If Abacus receives cash from exercised warrants and deploys another ~$300m at their historical rates of return, it could add ~$60m of earnings to the business. With most of the insiders locked up and the warrants callable if shares trade above $18, I think this is an interesting possibility:

Abacus Warrant Terms (Abacus 10-Q)

Abacus is an interesting investment today, trading at a $400m market cap and 11x annualized EBITDA with solid historical investment returns. It becomes a very, very interesting investment if net income can more than double off the back of a capital injection from the warrants.

Risks

- In the event Abacus receives additional capital injections (like the $35m of fixed senior notes they have just raised) they may deploy at lower incremental returns on capital. Abacus likes to highlight how untapped the market is for their services, but there is a risk they have captured many of the most valuable opportunities in the market.

- Because of the financial nature of Abacus and its position as a middleman purchasing and selling investments, there will always be a risk of “something” going sideways. I think their business model cracks the code where Emergent failed, but we may eventually learn of a fatal flaw in the Abacus business model as well. For example:

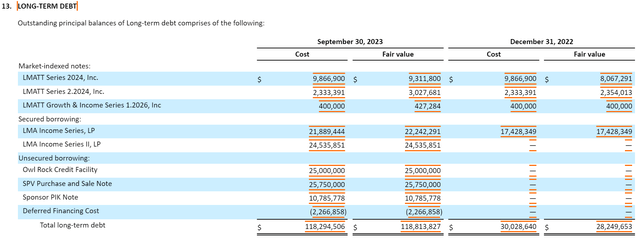

- Abacus’s debt includes the following indexed private placement notes, some of which are indexed to the S&P 500. In the event of significant market moves, Abacus will have significantly divergent obligations under these notes. They are hedged via options, but this is something to be aware of:

Abacus Debt (Abacus 10-Q)

- These notes also include a $10m related-party Sponsor PIK Note and a $25m SPV note with 12% interest. I don’t see any evidence that these were done on adverse terms to Abacus, but I want to flag the unique debt situation for any prospective investors. Were Abacus to receive a significant portion of the capital from the warrants, these arrangements could be paid off or negotiated on better terms. The $35m senior notes were already used to pay off the Owl Rock Facility and lower the cost of capital.

Conclusion

Abacus Life appears to have carved out a niche in an industry with a difficult public company past. Their former JV and current results suggest they have built the business to thrive through difficult market environments and profit in the face of rapidly rising rates. Going forward, investors will learn if Abacus can effectively deploy incremental capital to earn attractive returns and grow their business. I like the unique business model and Management’s alignment and look forward to following their progress as the only public life settlement business.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.