Top 7 Ways to Spend your Life Settlement Money

Congratulations! After years of working hard and careful spending, you get to open your wallet after receiving a bounty of cash from selling your life settlement policy. These are the top 7 ways to spend your life settlement money.

Still not sure whether selling your life insurance policy or even part of it, is right for you? Head over to our Life Settlement FAQ page to learn more.

1. Christmas.

The holiday season is upon us! We all know how much you want to spoil your grandkids with a fun new toy or a brand new PS5 they have been talking about. By selling your life settlement policy, you can even afford to give your not-so-friendly neighbor a gift this Christmas!

2. Get that second (or maybe third) car.

You might consider buying the flashy new Telsa you have been eyeballing (complete with an automatic chauffeur) after spending years sharing one car with your partner. Time to explore the open world, the possibilities are endless.

3. Timeshares.

For people in their retirement, timeshares seem like a dream vacation and it’s easy to be lured into the false promise of a cheap vacation. But unlike a vacation home in the Bahamas (which you can now afford), a timeshare is NOT an investment. Think of it as a fancy hotel that you are stuck footing the bill for over the next 20 years even when you aren’t using it.

4. Health care/ Health bills.

When times get tough, especially during the COVID-19 era, consider using your life settlement money to pay off your hospital bills. There is no reason to get into additional debt when your life settlement should be treated as an asset. You can also use some of the funds to pay towards health insurance, so you save money in the long run. According to Investopedia, there are five key factors that were associated with healthcare increases.

- Service price and intensity

- Population growth

- Population aging

- Disease prevalence or incidence

- Medical service utilization

“It is no news that Healthcare gets more expensive the more the population grows and as people get older and living longer. It’s not surprising that 50% of the increase in healthcare spending comes from increased costs for services, especially inpatient hospital care. Nor is it a shock that the two next highest factors increasing such spending are population growth (23%) and population aging (12%)”

5. Supporting your adult children.

Times are different for young millennials and Gen-Z’s. Wages have stagnated, Companies are now forced to let go of their employees and it takes longer to save for a house while dealing with massive college loans. With your bonus life settlement cash on hand, you can support your adult children as they survive through this year. According to The Emerging Millennial Wealth Gap, Millennials are earning significantly less than baby boomers did at the same stage of life. This is in spite of overall high education levels.

“Millennials today holds 41 percent less wealth than a similarly aged adult in 1989. Whether or not this cohort gets back on track or misses out on the experience of wealth-building altogether will have long-term impacts and broad ramifications.”

6. Housing.

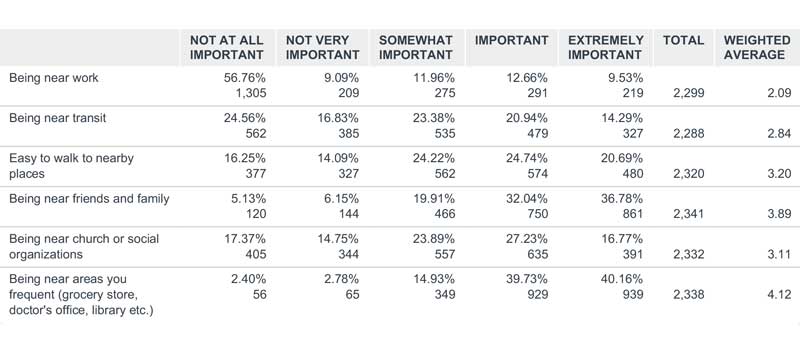

Downsizing your living situation is very common amongst people in their golden years, especially during these times, but with your life settlements funds in the bank, you can pay off your current mortgage and consider living in a resort-style assisted living community or moving closer to family. According to a recent poll by RetirementLiving, 36.78% of retirees say it’s extremely important to be near friends and family in this stage of their life.

7. Food:

“According to the Bureau of Labor Statistics data, “older households” – defined as those run by someone 65 and older – spend an average of $45,756 a year, or roughly $3,800 a month.” An average Retiree has only about $198k in their savings accounts, and with most couples living off a pension and social security checks, Food expenses can easily add up. But with your bonus life settlement money, you can afford to pick up a 32 oz Filet Mignon from the grocery store for dinner or even decide to have your food catered by a chef at least once a week.

About Abacus:

You’ve built equity in your life insurance policy. That policy is your property, not the insurance company’s. You have the power to decide how the policy should be used for you and your family. Deciding to pursue a life settlement is a legitimate and reliable choice to create financial options for your future. Life insurance is often a senior’s largest asset and one they can use to alleviate retirement challenges.

Why Abacus Life

At Abacus Life, we empower you with the information you need to decide if selling your life insurance policy, or a portion of it, is right for you. We will walk you through the entire process. We will show you the numbers and the numbers behind the numbers — all policy valuations, underwriting, cost, and returns — so you can make an informed decision for your family’s financial future.

At Abacus, we understand that you, like many other people, may have a policy that no longer meets its goals. We are dedicated to helping you learn the facts about your life insurance options so you can make an informed decision and get the most out of your policy. We are committed to serving you with the confidentiality, transparency, and urgency you deserve. Whether you are interested in a traditional life settlement, retained benefit option, or a hybrid option, Abacus Life can help you identify the right option for your circumstances.

We don’t want our clients to “settle,” we want to help them find real value in their personal property.

Click here to learn more about our one-step qualifier or visit us here to schedule a call.

Do you have more ideas of the Top 7 ways to spend your life settlement money?